At Prideview, we’ve considered the impact of increased taxation on the property sector, specifically, some of the key changes investors should be aware of and how we can support you with your commercial property investments.

Changes to Residential Stamp Duty

The most drastic change in the property market has been the residential stamp duty surcharge. According to the government, this will ‘disincentivise the acquisition of second homes and buy-to-let properties, freeing up housing stock for main home and first-time buyers.’

From our perspective though, this simply penalises hard-working savers looking for stable, long-term, income-producing assets, which can also be financed – namely real estate.

No other asset class provides this, and fortunately, the treatment of commercial (and mixed-use) property has not been as harsh – so investors can still have hope.

What are the New Residential Stamp Duty Thresholds?

Second Homes, Buy-to-Let, and Company Purchases will now pay an extra 5% up-front on the existing tiered Stamp Duty rate, summarised as follows:

- Up to £250,000: 5%

- The next £675,000 (the portion from £250,001 to £925,000): 10%

- The next £575,000 (the portion from £925,001 to £1.5 million): 15%

- The remaining amount (the portion above £1.5 million): 17%

There are some reliefs available; however, the most common one we have seen used, multiple dwellings relief, has now been abolished.

Commercial or Mixed Investments: Substantially Lower Stamp Duty

The stamp duty system for commercial properties and mixed properties (i.e., a shop with flats above) is now much more favourable.

Stamp Duty Values at Different Purchase Prices

| Purchase Price | Residential | % | Commercial | % |

|---|---|---|---|---|

| £250,000 | £12,500 | 5.0% | £2,000 | 0.8% |

| £500,000 | £37,500 | 7.5% | £14,000 | 2.9% |

| £750,000 | £62,500 | 8.3% | £27,000 | 3.6% |

| £1,000,000 | £91,250 | 9.1% | £39,500 | 4.0% |

The fact that mixed investments often contain a sizable portion of residential property suggests such investments will be even more popular.

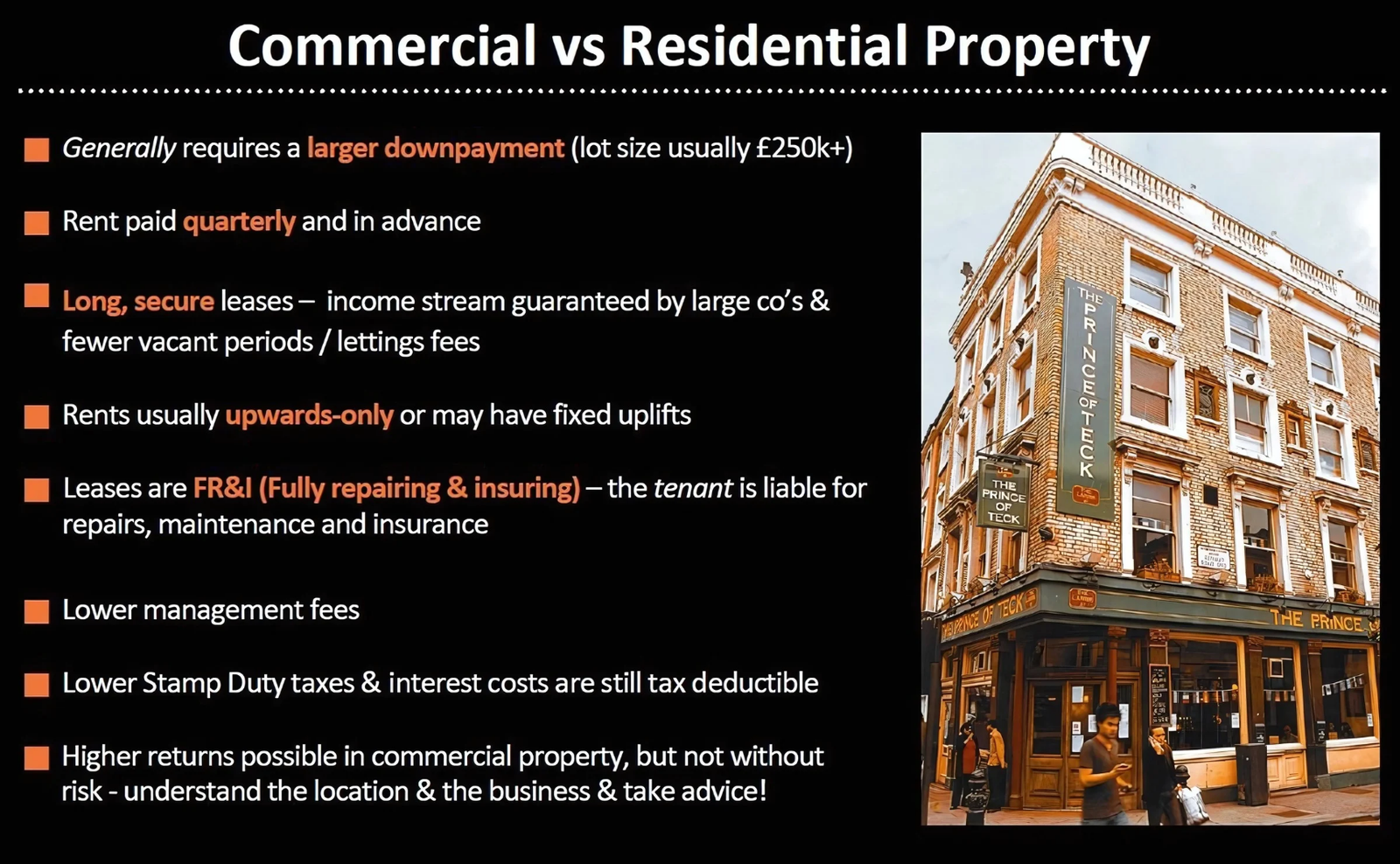

Additional Comparisons Between Residential and Commercial Property

Regarding taxation, for residential properties held in one’s personal name, the (often high) interest costs are no longer tax deductible – meaning it’s not uncommon that the income tax on rent received may exceed the actual cash return on investment.

On the flip side, investors open to pure commercial (i.e., not mixed) properties can enjoy the further tax benefit of acquiring via a Self-Invested Pension Plan (SIPP), meaning that their pre-tax income can be put directly into property without losing control of which property they buy.

From a management perspective, owning and renting a flat requires active management and compliance with regulations which most simply don’t do, or they pay local agents handsomely for doing so on their behalf. Commercial property, on the other hand, typically features rents paid quarterly in advance and Fully Repairing & Insuring leases, which means the tenant, not the landlord, is obliged to carry out all maintenance of the property.

How Can Prideview Help You Make a Commercial Property Investment?

If you feel the security that residential investment offers is now outweighed by the management headache, punitive taxation, and lower returns, then read on to understand what the deal is for commercial property.

Remember that, unlike residential property, commercial property will not always have a tenant waiting in the wings, and whilst some high streets and towns are thriving, many are not.

We specialise in helping private investors looking for a reasonable – but not ridiculous – return and long-term security in commercial property. We have a track record of sourcing properties that attract strong finance, have realistic chances of being let for the long term, and have leases of 5 years upwards in place to blue-chip tenants with PLC covenant strength.

Above all, the most important thing is to get sight of the deal in the first place.

To be kept in the loop and to join our exclusive mailing list, please register on our website www.prideviewgroup.com with your number and email address or contact us on our dedicated WhatsApp number (+44 20 4516 5126) – we will then call back to discuss your requirement in confidence.

A Final Word on Tax Considerations

Please note there are other taxes to be mindful of when investing in property – Capital Gains Tax, Corporation Tax, VAT and Inheritance Tax to name but a few. Please always take advice from an accountant when deciding the optimal structure for your circumstances and as always, we would be happy to make any introductions.

Contact Nilesh Patel at Prideview